does the irs write off tax debt after 10 years

If they do not collect it within that 10. Under most circumstances it has 10 years from the assessment date to try to collect.

How To Get Out Of Tax Debt Credit Repair Com

Does IRS forgive tax debt after 10 years.

. After the statute of limitation expires the uncollected tax debt older than 10 years is wiped from the IRSs books that means the IRS has to write it off. Its important for taxpayers to find out if their. So just how long does the IRS have to collect a debt.

This rule is against the interest of tax. Work with a tax accountant or CPA who is positive about giving you more freedom from tax debt. As already hinted at the statute of limitations on IRS debt is 10 years.

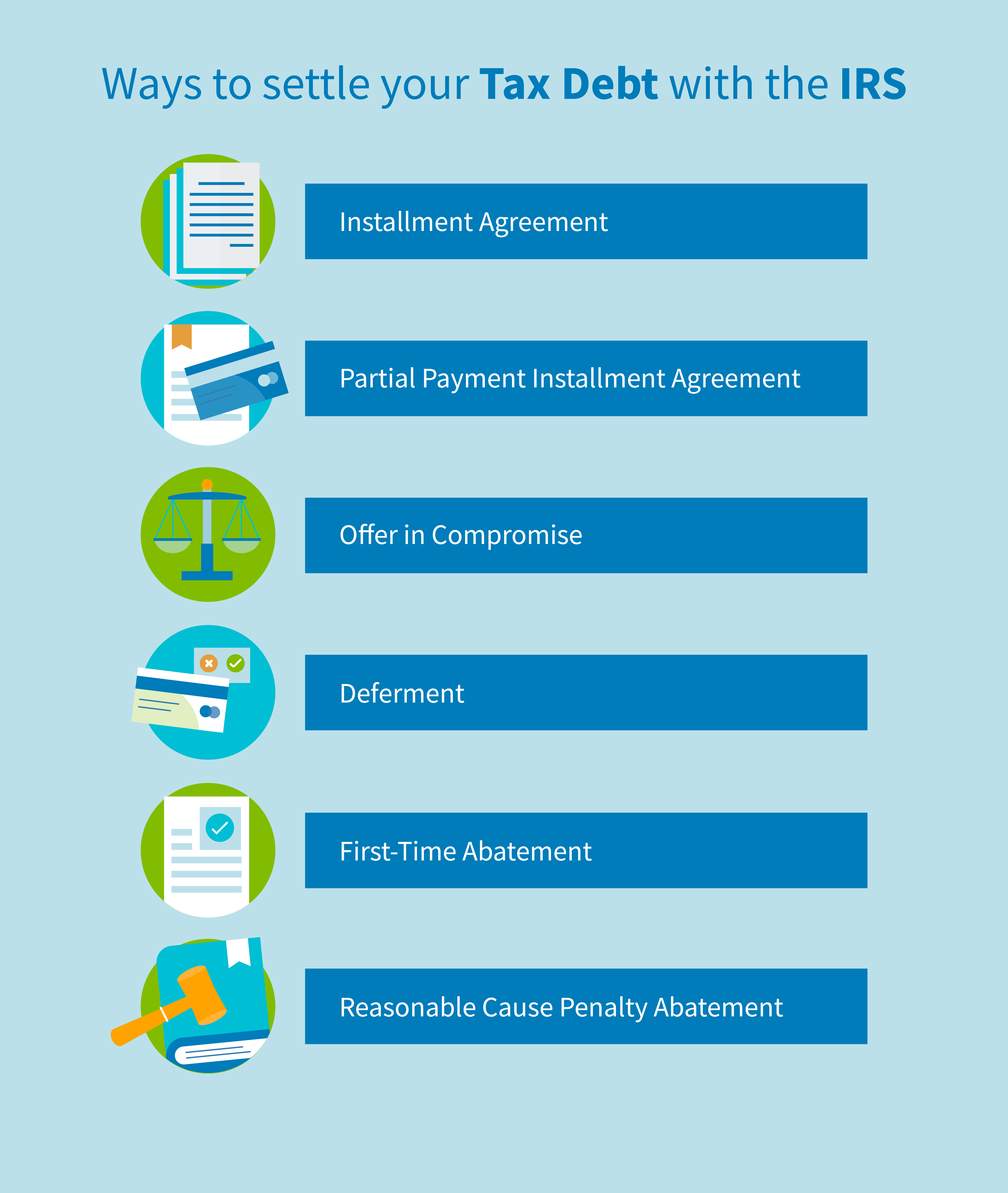

In the meantime youre doing the right thing by learning more about tax debt. The IRS does have the authority to write off all or some of your tax debt and settle with you for less than you owe. Has 10 years from the date that they assess the debt to collect it.

While most taxpayers receive a reprieve on their tax debt after ten years in some cases the IRS still has the ability to collect on an old debt. Assessment starts the clock running on the ten years. After that it will vanish.

Get the Help You Need from Top Tax Relief Companies. This is called an offer in compromise or. The IRS then has up to three years after accepting your return to assess the tax owed.

This means that under normal circumstances the IRS can no longer pursue collections action against you if. The IRS refers to this as a Collection Statute Expiration Date Internally IRS. You Dont Have to Face the IRS Alone.

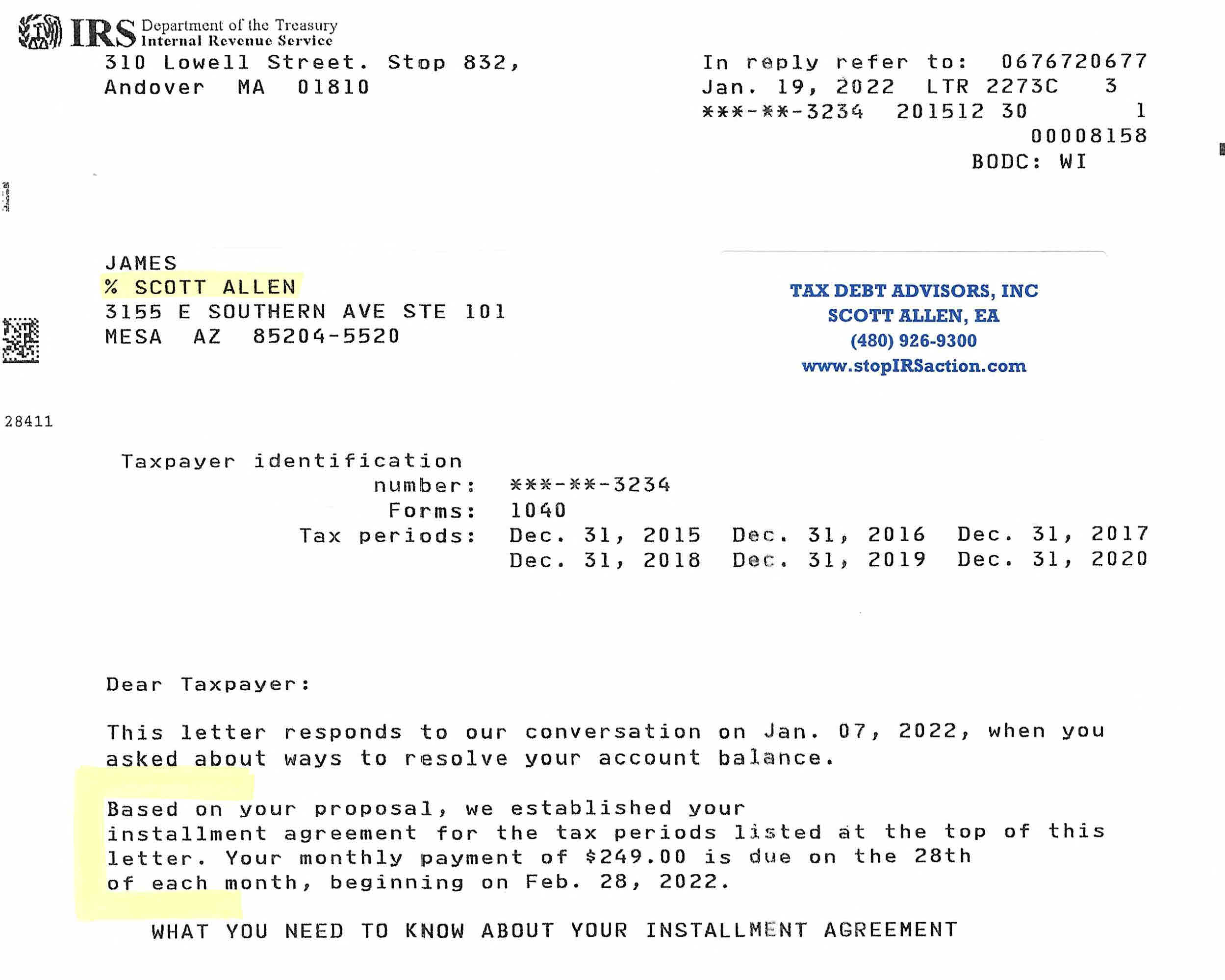

The answer is that the IRS has 10 years to collect a debt after it is assessed. If you want to settle your taxes with the IRS it is possible but very rare and does not happen often. End Your Tax NightApre Now.

For example did you know that the IRS only has 10 years to collect on your tax debt. The IRS has 10 years to collect a tax debt. The 10 years starts at the debt of assessment which is.

Yes If Your Circumstances Fit. The IRS most definitely has the authority to write off some or all of your tax debt. Specifically Internal Revenue Code 6502 Collection After Assessment limits the IRS to 10 years to collect a tax debt.

In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. So take a look at the post above where we offer a flat fee. However a charge off does not mean the debt is forgiven.

Ad 5 Best Tax Relief Companies 2022. For example after filing your 2010 taxes in 2011. Posted on Feb 26 2014.

All of that quiet debt does go eventually go away. The IRS typically has 3 years after the initial assessment to tax audit whether you owe additional taxes for a particular tax year. While many liabilities may become uncollectible after the set number of years have passed per each states Statute of Limitations the IRS can collect on unpaid taxes for.

Irs Collections What Is The Collection Process Next Steps To Take

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

Does The Irs Forgive Tax Debt After 10 Years

Back Tax Returns Tax Debt Advisors

Does Irs Debt Show On Your Credit Report H R Block

How Long Can The Irs Try To Collect A Debt

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions

Irs Tax Debt Relief Forgiveness On Taxes

The Proven Way To Settle Your Tax Debt With The Irs Debt Com

How Far Back Can The Irs Collect Unfiled Taxes

Does Owing The Irs Affect Your Credit Score Community Tax

What Happens To Federal Income Tax Debt If The Person Who Owes It Dies

Irs Debt Forgiveness And Irs Tax Forgiveness Services

Tax Bill Suprise For Old Debt The Irs Is Now On Your Side

Can The Irs Take Or Hold My Refund Yes H R Block